Budgets & Audits

Click on the following underlined links to access the districts budgets & audits

1. Instructional Programs ($1,591,378)

These are direct classroom costs that support teaching and learning:

Teacher Salaries & Benefits – classroom teachers, special education teachers, aides/paraprofessionals.

Classroom Supplies & Materials – instructional materials, textbooks, workbooks, technology used for instruction.

Special Programs – vocational education, special education, gifted and talented, preschool.

Stipends/Instructional Extra Duty Pay – tutoring, extended learning.

2. Support Services ($1,838,209)

These are “behind the scenes” services that make instruction possible:

School Administration – principals, office staff, clerical support.

District Administration – superintendent, business office, HR, technology staff.

Operation & Maintenance of Plant – custodians, utilities, repairs, building maintenance.

Pupil Transportation – bus driver salaries, fuel, bus maintenance, bus purchases (non-capital).

Instructional Support – counselors, librarians, nurses, instructional coaches, professional development.

3. Non-Instructional Programs ($197,809)

These are student services and activities that fall outside the classroom:

Child Nutrition Program – food service staff salaries & benefits, food purchases, kitchen supplies.

Student Activities & Athletics – coaching stipends, referees, uniforms, travel, supplies for extracurriculars.

4. Capital Assets ($40,808)

These are costs associated with long-term assets and investments:

Capital Outlay – purchase of technology, buses, equipment, furniture, playground improvements.

Facility Upgrades/Repairs – building improvements that extend useful life.

Depreciation – annual write-down of the value of district-owned facilities, vehicles, and equipment.

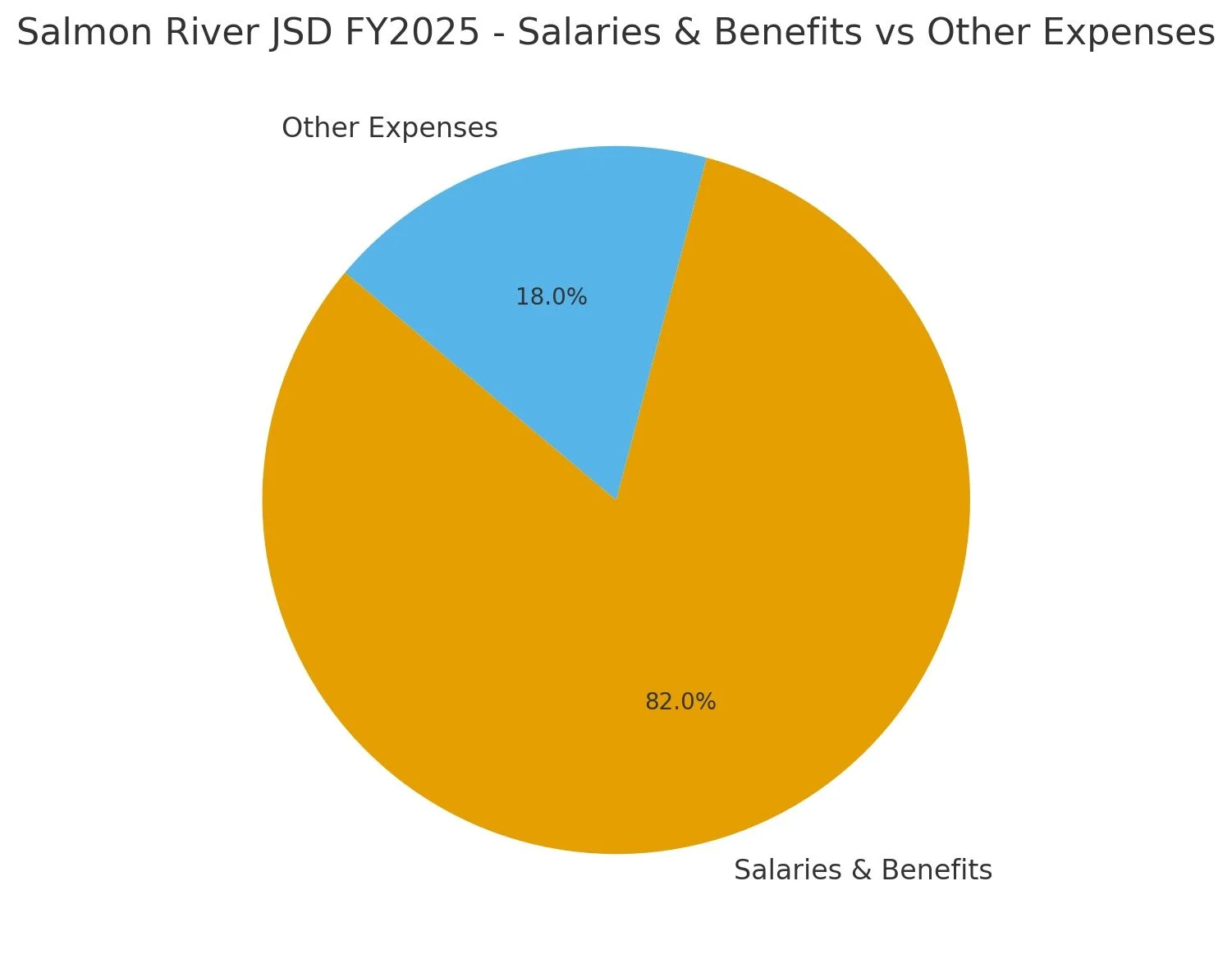

FY2025 expense breakdown from the 2025 audit:

Salaries: $2,129,540

Benefits: $856,601

Other Expenses: $664,327

This chart shows that over 80% of the district’s budget goes to employee compensation.